How To Make ESIC Online Payment: The last date for the monthly Employee’s State Insurance Corporation or ESIC (in general) payment is the 15th of each month. (Before 2019 it was 21st of every month). However, to remain safe, it’s better to do it on your own as one can pay through internet baking as well provided they know the ESIC payment process. The main objective of the ESI Scheme is to provide hassle-free smooth services to both employers and employees through its information portal and services portal. As part of this effort, all compliance and payments are covered online payment system. ESIC Online Payment

Below is the step by step guide for ESIC Online Payment:

For online payment of the ESI, you necessarily require these two components:

- User ID and password for the ESIC portal

- Netbanking Id and password for SBI bank

Step 1:

Go to the official ESIC website by clicking on the link: https://www.esic.in

You should keep in mind that this link is only compatible with either Mozilla Firefox or with Internet Explorer version 7.0 or higher than that.

ESIC Online Payment

Step 2:

Log in by clicking on the ‘click here to login’ option on the right side of the screen using the user ID, Password & captcha. After successfully logging in, you will see a list of various links that will redirect you to the esic selected portal.

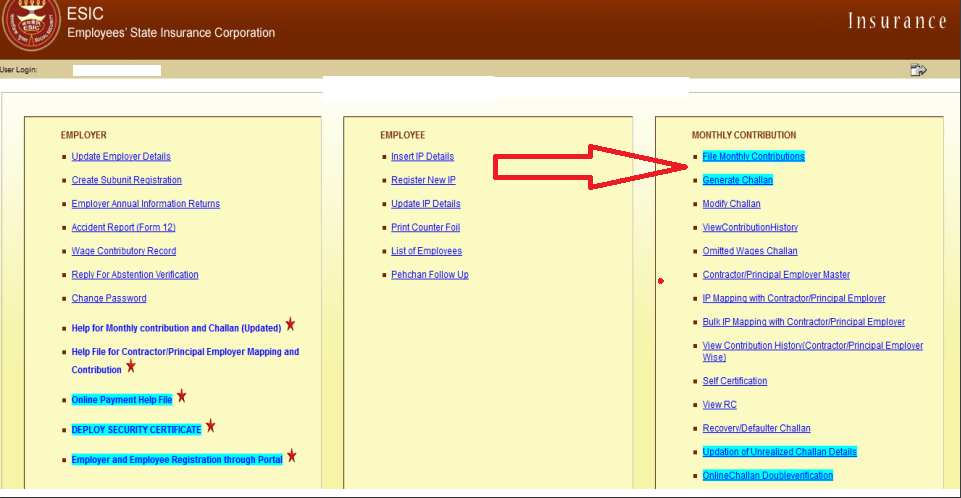

Filing Monthly Contributions; ESIC Online Payment

Step 3:

The process for filing the monthly contributions and generating e-Challan is easy to follow. After logging in, choose ‘File Monthly Contribution’ from the right side under the ‘Monthly Contribution’ tab. But before filing for the monthly contribution, an IP (Insured person)/the employee is registered with the ESIC portal and correct information has been furnished by the employee. After selecting the ‘File Monthly Contribution’, fill in all the details asked on the computer screen.

Step 4:

Select a month and a year for which the contributions wanted to make. You will be asked to put in the employer’s code and option through which you can upload the data. This will give you two options for uploading the data. One is by uploading the excel file and the other is by putting the entry of the contributions online.

Step 5:

By uploading the excel sheet: Click on the ‘Sample MC excel template’ and save the template. Fill in the information of a 10 digit employee number (IP number), employee name, number of working days, total wages, and last day of employment(if the employee has left work or any other reason). The system will automatically calculate the employee’s and the employer’s contribution. Save the file at the desktop or wherever you want. To upload the file, click on ‘Upload Excel’, browse the file from your computer, select it and click on ‘Upload’.

Entering Contributions Online: ESIC Online Payment

Step 6:

This is another way through which you can fill in the contributions. After filling all the details, click on ‘Submit’. Fill in the details like the number of days, monthly wages, and the number of days worked. The system will automatically compute the contributions.

Step 7:

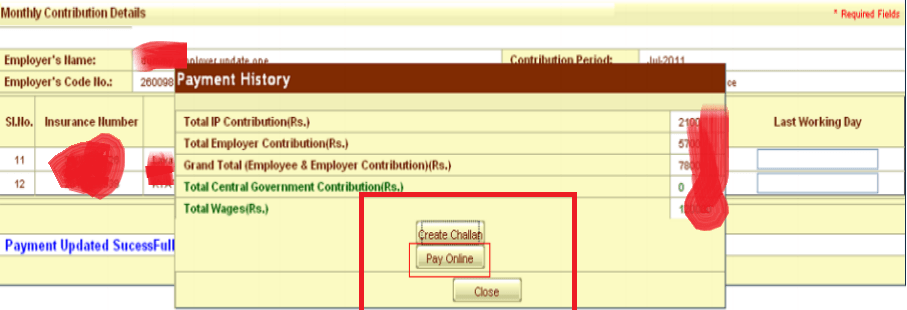

You will get this window once you click on the ‘Preview’ button. Now you need to verify the information and check the ‘Data Verified’ option and click on ‘Submit’. After submitting the details, you can pay online via the SBI net banking portal by selecting the ‘Pay online’ option. Now enter your Bank details by logging in and pay the shown amount. You can also take a screenshot or a print of the payment reference number for your general record purpose.

Generating Challan Online: ESIC Online Payment

Step 8:

For Generating Online Challan, visit the ESIC website. Select ‘Generate Challan’ under the ‘Monthly Contribution’ option on the right side of the computer screen. After clicking on that you will be re-directed to another screen. Enter the code and click on ‘View’. This will display a list of records you have entered earlier. You need to select a record against which the user wishes to make a payment. Enter the amount which needs to be paid. Select the online mode and submit the details.

Step 9:

After you submit the details, a message will appear and will need your approval. So click on ‘OK’ and this will take you to the next step. After confirming, it will generate a challan number as it generated under ‘filing the contributions online’. After the challan is generated, you will be taken to the SBI net banking portal. Log in with your credentials and select the net banking account. Verify the information and click on ‘Confirm’. Now, you will be re-directed to the ESIC portal with details of the successful transaction. You can either save this page or take a print.

Printing/ Re-Printing the Challan: ESIC Online Payment

Step 10:

Click on ‘Online Challan Double Verification’option under ‘Monthly Contributions’. After you have clicked on the link, you will be taken to the challan double verification page. Enter the Employer’s code along with the challan number. After that, click on submit and it will give you the summary. From here, you can either save it or print it.

What is ESIC?

Employees’ State Insurance Act, 1948(ESI Act), by the Parliament was the first major legislation on social Security for workers in independent India. The deployment of manpower in manufacturing processes was limited to a few select industries such as jute, textile, chemicals, etc. The legislation on the creation and development of a foolproof multi-dimensional Social Security system. The ESI Act 1948, encompasses certain health-related eventualities that the workers are generally exposed to; such as sickness, maternity, temporary or permanent disablement, Occupational disease or death due to employment injury, resulting in loss of wages or earning capacity-total or partial.

Related Keywords:

esic online payment, esic result, esic e payment, esi card, esic portal application, esic portal application, esi health insurance, esic payment, esic online payment, esic contribution, esic benefits.

Disclaimer:

Kindly note that this site is not the official website of the ESIC organization. We provide information available from the internet and the information available on epfoadvise.co.in may vary to the actual information. We collect information online from different resources including the official website of the ESIC organization.

If you find any information wrong or corrections needs to do, you are requested to kindly contact us.

Leave a Reply